The Shift in Africa’s Tech Funding: Equity Leads, Debt Grows

As we discussed previously, the interplay between local and global investment continues to shape startup financial strategies in Africa’s evolving tech ecosystem. Amidst this backdrop, 2023 has marked a turning point with the rise of debt financing, which will supplement the traditional equity funding model. While equity remains the lifeblood of startups, providing not only capital but also valuable networks, debt financing is carving out a niche. It provides a non-dilutive funding option that appeals to more mature startups looking to preserve equity while securing growth capital.

In this follow-up article, we will look into each aspect of this trend. The year 2023 has demonstrated the African tech sector’s resilience and adaptability, with startups exploring a balanced mix of equity and debt to combat financial challenges. Despite the global venture capital slowdown, equity funding has remained the preferred source for African entrepreneurs. However, the narrative is broadening with the emergence of debt financing as a strategic alternative, providing a promising path for long-term growth in the face of economic uncertainty.

The State of Equity Funding

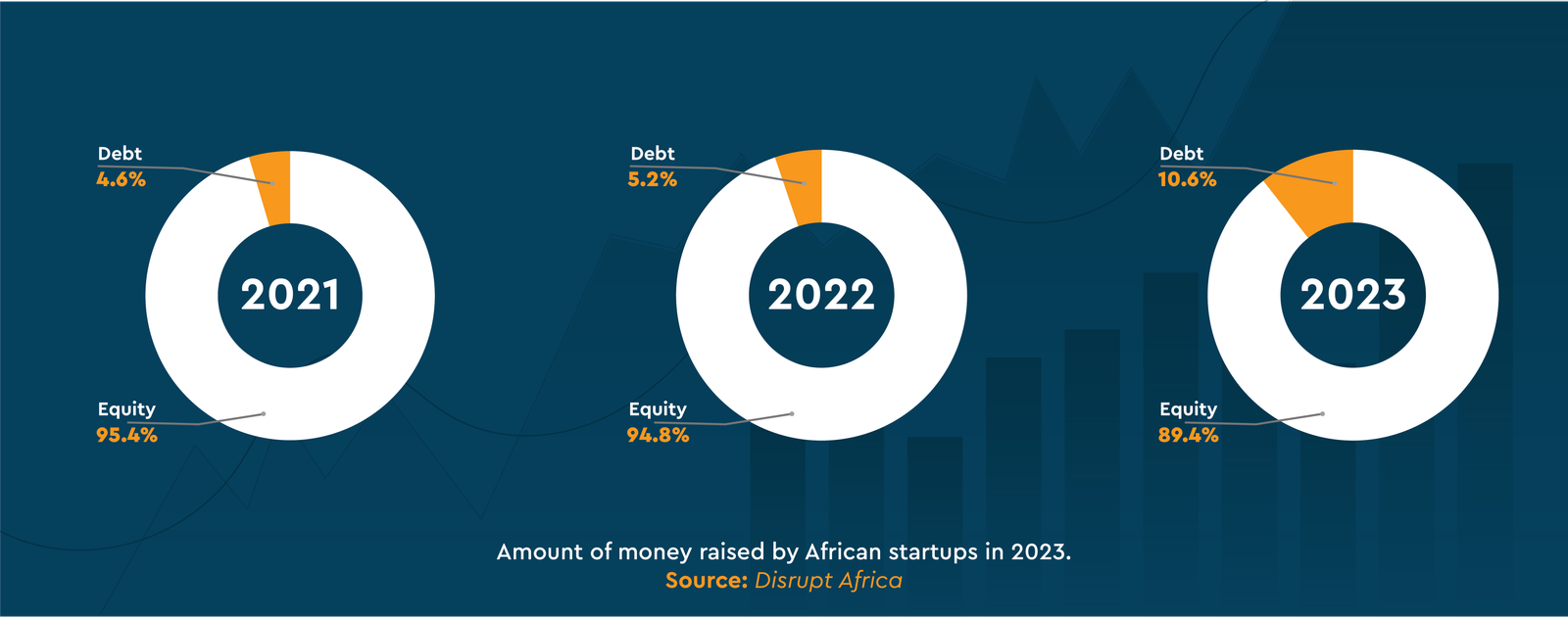

Equity funding, while still the most common type of investment, has seen a relative decrease in 2023, with a 5.4% drop from 94.8% in 2022. Generally, African startups raised $2,406,914,000, marking a 27.8% drop from the previous year, spread across 406 startups (According to a report by Disrupt Africa). This decline mirrors the global venture capital funding crunch, as investors have become more cautious in their funding strategies. The “big four” markets—South Africa, Nigeria, Egypt, and Kenya—continue to secure the majority of deals, although their share has slightly decreased, indicating a diversification of investments across the continent.

Debt Financing on the Rise

In contrast to the decline in equity funding, debt financing has increased significantly, accounting for 10.6% of total funding in 2023, according to a report by Disrupt Africa. This represents a 5.4% increase from 5.2% the previous year.

Kenya, in particular, has led the charge in debt financing, with a significant focus on cleantech and fintech companies. This shift suggests that as equity becomes more challenging to secure, debt financing is emerging as a viable alternative for maturing startups.

The Implications of Diversified Funding

The increase in debt financing indicates that the African Tech Ecosystem is maturing, with startups looking for new sources of funding to fuel their expansion. This trend is especially beneficial for startups that can manage debt while maintaining their equity stakes. Furthermore, the rise of debt financing may indicate a more sustainable approach to startup funding, with companies encouraged to prioritize revenue generation and profitability.

Looking Ahead

As time passes, it is clear that the African Tech Ecosystem is maturing, with startups having access to a variety of funding options. The equity-to-debt ratio is likely to shift further as market conditions change. For startups, this means being more strategic in their funding approaches, taking into account the long-term consequences of their financial decisions.

To put it simply, while equity funding remains the foundation of startup financing in Africa, the rise of debt financing in 2023 is a trend that cannot be ignored. It reflects a larger shift in the ecosystem, one that presents new opportunities and challenges for startups attempting to navigate the complex landscape of venture capital.

If you found the article informative and worth reading, please subscribe to our newsletter at https://www.afrilabs.com/ and follow us on all social media channels (@AfriLabs).